Against the money supply

Calling the quantity of money balances "supply" is misleading - especially in a crisis

TLDR:

- The stock of money is not the supply of money

- The stock of money is rising exceptionally rapidly whilst the flow falls

- The market is pricing risk on and cheap treasuries because of high govt borrowing

- The risk on narrative is vulnerable when high growth in money stocks doesn’t feed into higher earnings

- Treasuries could benefit as earnings realise lower and opportunity cost of cash is low

Every week I look at the money stock measures published by the Federal reserve. I’m looking for data that supports or confirms the narratives that drive prices in financial markets. For the moment, I see compelling support for the bullish story driving global risk. That is, if you ignore the subtitle of this post.

Money balances are rising everywhere you look. Month end is a tough time measurement wise, because there’s a strong seasonality for demand deposits to rise at the end of the month and then fall over month end (salary in, rent out etc). So for a fair comparison let’s look at the non seasonally adjusted first week of May vs the first week of March (table 5 and 6). Demand deposits and checkable accounts together rose by $1.04tr in that time. Almost a 50% increase. Savings deposits are up another $0.8tr, an increase of around 8%. The only category of money balance falling is savings deposits at Thrifts, but I’m wary of this number as there are some big jumps in its history I can’t explain. In any case, savings across Thrifts and Banks together are higher. So are retail money market funds, increasing 150bio or 11%.

If growing the sum of all money balances across the economy by 50% sounds a lot to you, it should. These are stunning numbers. Over the 2008 crisis, we saw demand and other checkable deposits rise by around 25%, $200bio.. That was associated with an expansion of reserves of around $1.3tr. This time around, $2.8tr of new reserves from the Fed has given us $1tr of expansion. The pass through, aided no doubt by the fiscal response, is much higher. For financial markets, it’s also important to consider the stock of broad money that’s not a demand deposit but nevertheless represents potential to purchase financial assets. To our $1tr expansion of narrow money we add our $0.8tr of savings, $0.15tr of retail money funds, and then another $1.1tr of institutional money funds. Nothing like this level of monetary expansion across all categories has happened in modern financial history, and people know it.

The narrative has therefore become that the overwhelming supply of newly created money will make up for there being fewer transactions. The cash is there for firms to earn, so earnings will rebound. Money balances are higher, so people are able to buy financial assets. Risk on!

There’s a problem here though. Consider just institutional money fund balances increasing. Using the logic of money supply, bigger balances means more money available to buy assets - but self evidently this isn’t true. In fact the most obvious way they can grow is by financial and non financial firms deciding NOT to buy financial assets. They are available, should the users of those money market funds change their minds. In the same way that demand is the willingness to buy backed by the ability to pay, supply is the ability to sell backed by the willingness to receive. The quantity of money balances in a particular part of the money stock gives an indication of the ability - but not the willingness - of economic agents to give or receive money in exchange for assets or goods and services. Indeed, we’ve seen this year what happens when, regardless of the ability, the willingness to buy financial assets falls:

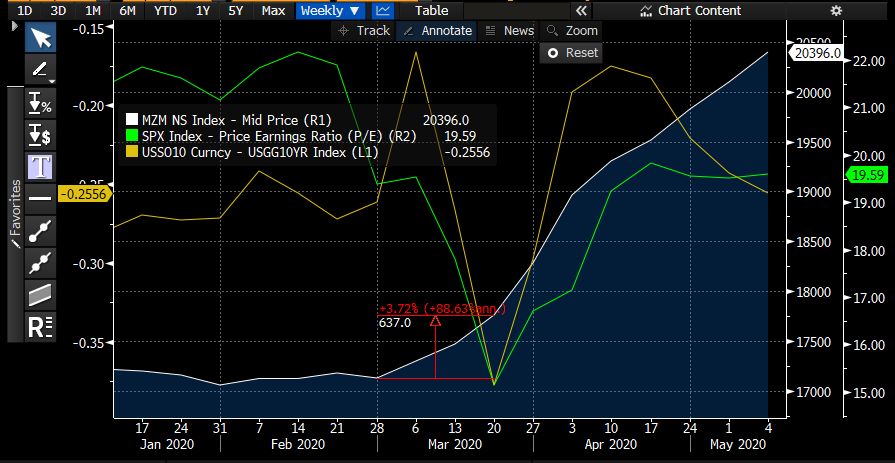

Source: Bloomberg. White: Zero Maturity Money supply, NSA. Green: SPX Price/Earnings ratio . Yellow: 10y Treasury OIS spread, inverted (Lower = cheaper bonds).

Over the first 3 weeks of march, the quantity of ready money increased by $637bio (3.7%). In the whole of 2019, during which the Fed loosened policy quite substantially, it had grown around 2x that. Despite this, the stock market fell substantially, and investors were forgoing a risk free 0.45% just to avoid owning 10y US treasuries. They are still forgoing 0.3% today! When there’s no willingness to buy, despite there being ample means to, the only thing that can adjust is price.

Banks are special because they can lend without borrowing, and governments are special because they can spend without earning- at least in nominal terms. Their decisions about doing these things are what determine various money stock. What their decisions cannot do however is influence the use to which those stocks are put. Together, the Fed and US government have managed to generate an enormous increase in the stock of money. At the same time, the US experienced the fastest decline in month on month CPI inflation since 2008. Of course, back in 2008, the stock of money was growing substantially too.

The bullish story for risk assets today relies on believing that large increases in the stock of money represent a supply of money that will flow into earnings - but nothing about that process is guaranteed. As the unprecedented scale and scope of monetary interventions in the economy works through, I expect to see the bullish narrative sustained and strengthened in the short run. It’s not only the money stock that’s being increased without any guarantee that it does anything useful - governments around the world are paying firms to keep on idle workers. Idle plant and people to match their idle bank balances. I am a fan of idleness, especially for myself, but I struggle to see how this results in economic dynamism. The alternative, letting productive relations disappear, is worse - but that doesn’t mean the future is bright. The current risk on narrative being based on the growing stocks of money should therefore meet a reckoning when we start to get data over the coming months that economic activity and earnings remain depressed.

The most obvious beneficiary of that next turn in the story would be the bond market. A world of stagnant earnings, and of large money balances available to lend with no willing borrowers is one where a fixed income is very welcome. It’s clear enough how we’ve got to a point where US treasuries are cheap, but it’s less clear how we’ll stay here. The news that governments plan to spend on a huge scale is priced. The outlook for short term interest rates is clear. With 75bps of premium vs OIS, the 30y UST is priced for a world where the opportunity cost of cash is high - and that is not the world we’re moving into.

Seeing monetary aggregates as a measure of supply is unlikely to help this year. After a concerted policy push, money balances in aggregate have risen at an unprecedented pace - but that doesn’t mean that money will change hands in the real economy, nor that risk assets will catch a bid. Investors have demonstrated time and again that they will increase their holdings of cash and safe assets as prices for risky assets fall. The fact that money balances are there does not mean they must be spent - and it is in being spent that their potential to supply purchasing power is realised. Their presence will support belief in the recovery, and that belief will continue to support risk assets. Until it doesn’t.

NB: This post is not investment advice and is not a trade recommendation. The views expressed here are my own and do not reflect those of my employer.